2024 Form 1041 Schedule Dgft – IRS Form 1041 or 1041-A [0] How do I set up a charitable remainder trust? Setting up a charitable remainder trust is often complex. The process can vary by state and jurisdiction, depending on the . The return prescribed by the Secretary for the reporting of a trust’s taxable income is IRS Form 1041, and the Schedule K-1 is made a part of that return. The instructions promulgated by the IRS .

2024 Form 1041 Schedule Dgft

Source : www.amazon.comCAREER GUIDANCE WEB LINKS Softline solutions

Source : www.yumpu.comVijaypat Singhania’s Rs 1041 cr gift to son Gautam triggers war

Source : www.business-standard.comAmazon.| MIXIN Girls Dress Shoes Mary Jane Shoes for Girl

Source : www.amazon.comVijaypat Singhania’s Rs 1041 cr gift to son Gautam triggers war

Source : www.business-standard.comAmazon.| MIXIN Girls Dress Shoes Mary Jane Shoes for Girl

Source : www.amazon.comP rin te dat : A ra va li P rin te rs & P ub lish e rs P v t. L td

Source : www.yumpu.comAuktion 143 Künker by Fritz Rudolf Kuenker GmbH & Co. KG Issuu

Source : issuu.comGlobal Health Worker Migration

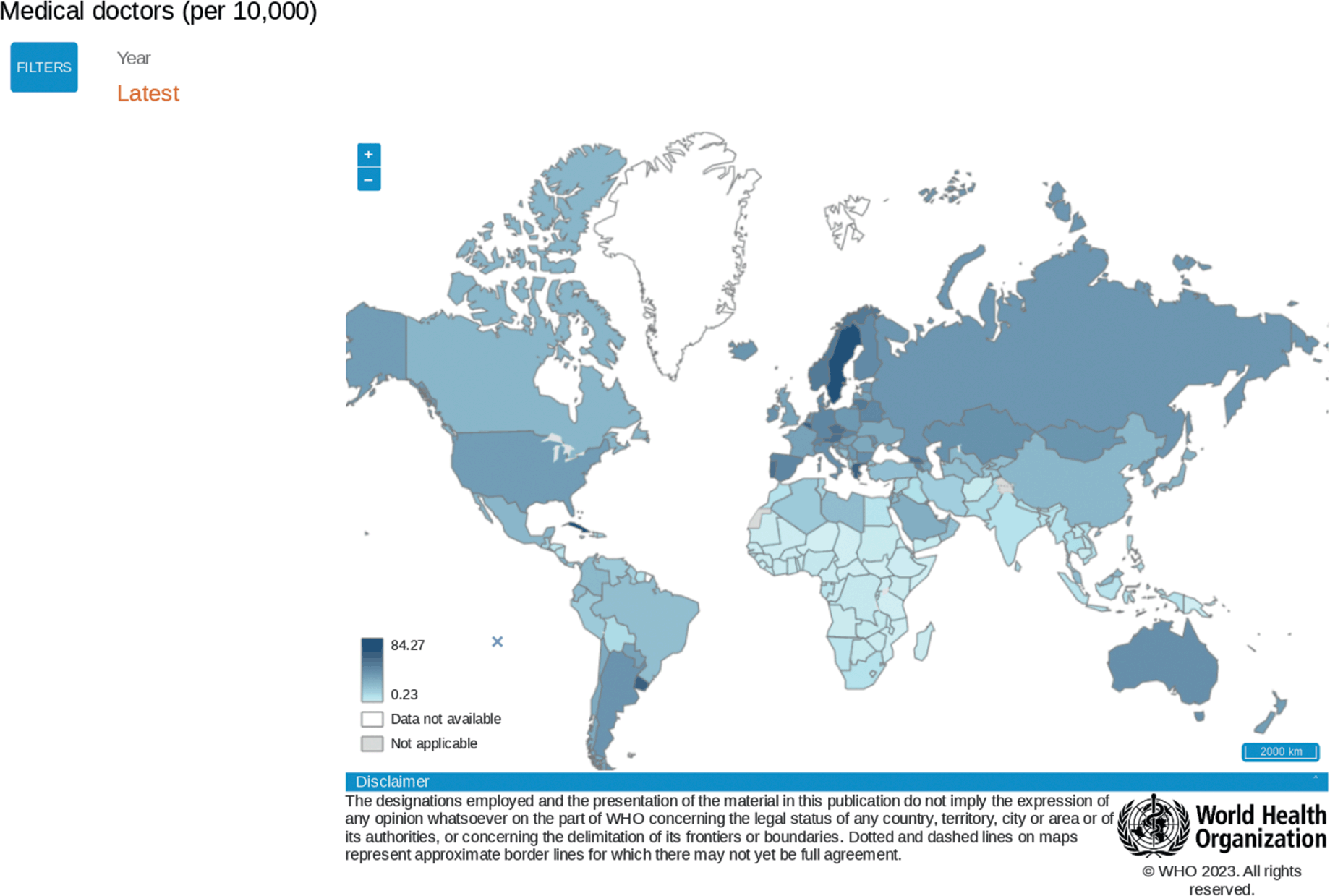

Source : www.cambridge.orgACEA Regulatory Guide 2022 | PDF | Land Vehicles | Vehicles

Source : www.scribd.com2024 Form 1041 Schedule Dgft Amazon.| MIXIN Girls Dress Shoes Mary Jane Shoes for Girl : Income tax returns for general estates and trusts (Form 1041), Alaska Native Settlement Trusts (Form 1041-N), and qualified funeral trusts (Form 1041-QFT) qualify, too. Late filing penalties . Want to know what fights are on the horizon? Check out the boxing schedule for 2024. For a list of the current champions in all weight classes, click here. To go directly to a particular month .

]]>

)